Perform employee background checks

One important thing you can do to be better at loss control is to perform background checks.

As Lauren Small at Greenhouse.io says1, "Talent acquisition and talent management both require a huge investment of time and resources, so it makes sense to do your due diligence before bringing a new hire on board. First and foremost? Make sure that the person is exactly who they are claiming to be. This includes confirming what's stated on résumés—from education to work experience to certifications and awards-as well as verifying the criminal history of the individual. Doing so will reveal any red flags that could potentially affect trust, safety, and your company's bottom line."

Accident prevention and safety inspections

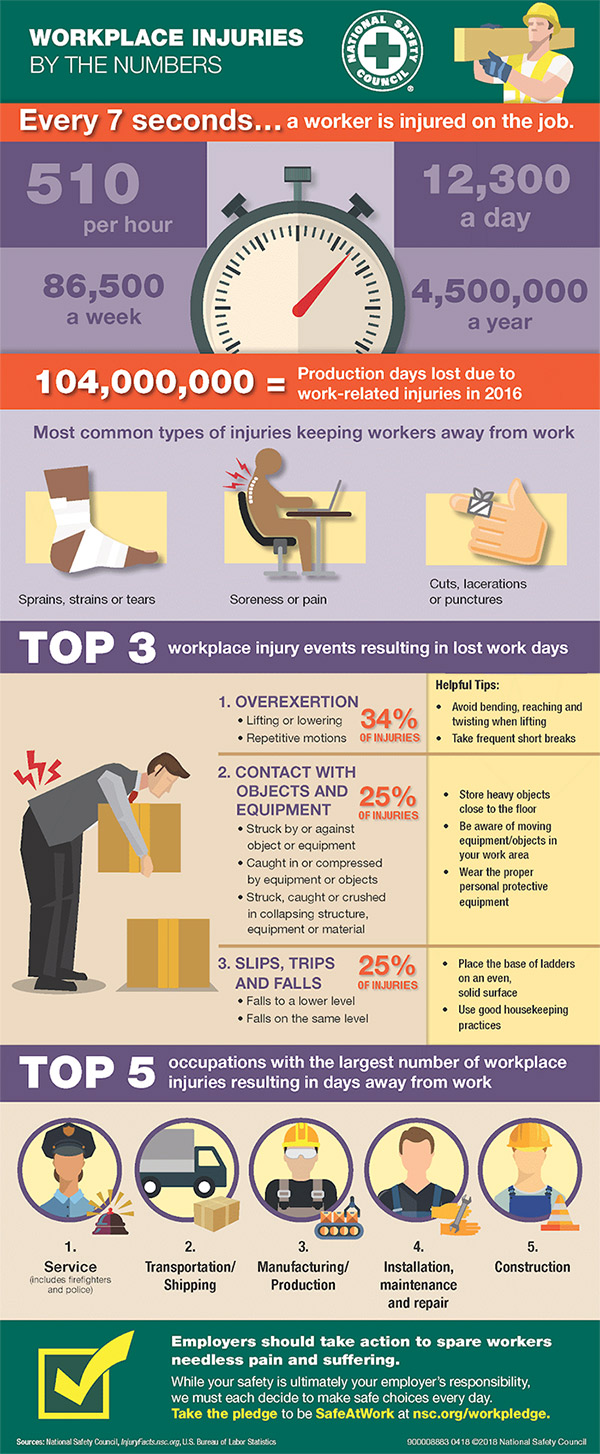

According to the National Safety Council2, a worker is injured on the job every seven seconds. This is an alarming statistic and one that should be taken very seriously by any employer.

Have regular safety inspections performed and talk to employees about how accidents can be avoided based on the work environment provided.

Have Employment Practices Liability Insurance (EPLI)

No business owner likes to think it can happen to them, but you need to be prepared for loss that may come from potential lawsuits stemming from disgruntled employees. Employment Practices Liability Insurance, which Nationwide offers, can help protect you from claims related to discrimination, retaliation, harassment, and wrongful termination. It can even help protect you against claims about other employment issues, such as failure to promote.

Consult professionals

If you're a small business owner, there's a good chance that a loss control plan hasn't been at the forefront of your efforts. You're likely busy trying to manage numerous aspects of your business, and you may simply not have time to give much energy to this all too important facet of your enterprise.

If this is the case, it's a good idea to reach out to professionals who have experience at this. Nationwide has a Loss Control Services team with safety and risk management professionals around the country. They will review your operations, procedures, and programs, and provide analysis, reviews, and investigations. The team includes: professional engineers, certified industrial hygienists, certified safety professionals, associates in risk management, construction and risk management specialists, nursing home administrators, and certified automotive fleet specialists.