Key takeaways:

- Many investors continue to link election outcomes with market performance and investment returns.

- The strong emotions surrounding elections affect investor perceptions about the future, which can lead to poor investment decisions.

- Remind clients that stocks have performed well throughout different political cycles and help them focus on their long-term investment goals.

October 15, 2024 – With Election Day 2024 just around the corner, headlines about the presidential campaign will increasingly overwhelm the national conversation. Election contest news can produce strong emotions, especially among politically motivated investors. These emotions can shape expectations for future market performance and ultimately influence the financial decisions investors make.

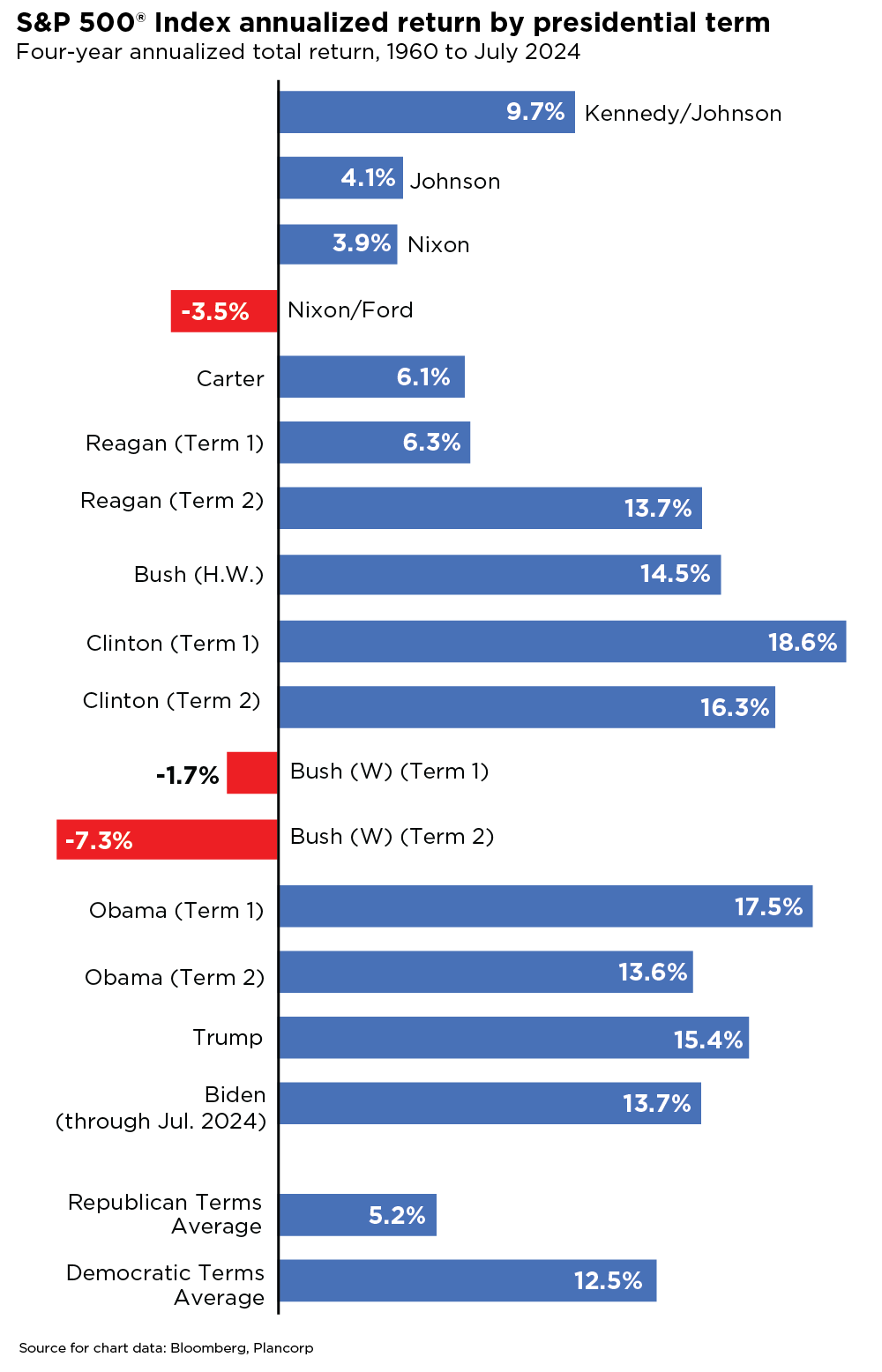

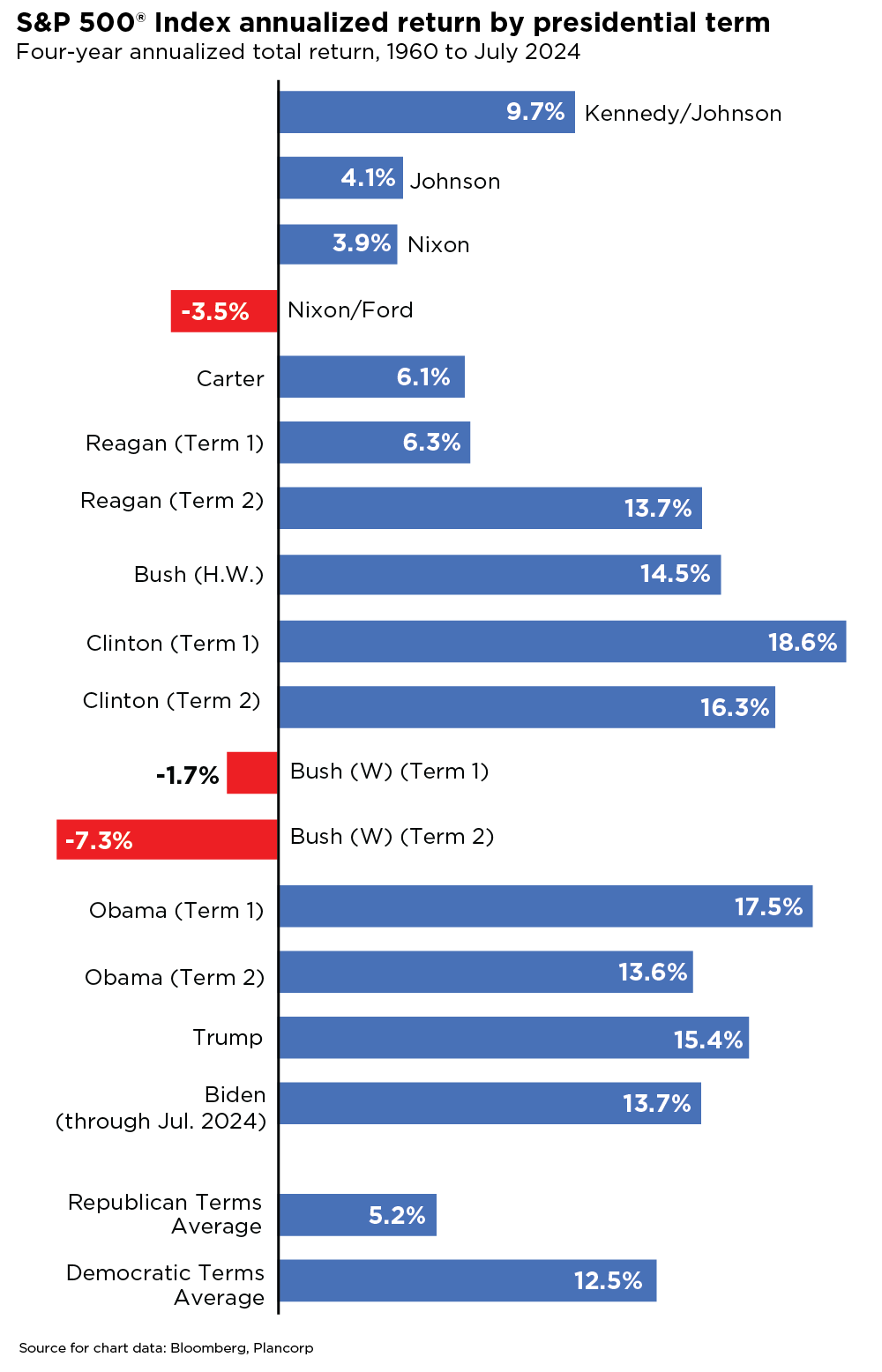

The latest Advisor Authority survey, powered by the Nationwide Retirement Institute®, found that three in five investors (61%) believe the outcomes of presidential elections have a direct, immediate, and lasting impact on stock market performance. However, the actual performance of stocks through different White House administrations shows otherwise; stocks have historically performed well through various political eras, irrespective of which party holds the presidency. (See the accompanying chart.)

The factors that actually influence the performance of stocks over the long term are company earnings, profit margins, innovations, and the business cycle. These fundamentals are where investors should focus their attention, rather than on the daily noise emanating from the presidential campaigns.

This may seem obvious to seasoned financial professionals who have lived through several election cycles, but the emotions surrounding the upcoming election are currently affecting investor perceptions. Our survey also found that 55% of investors believe election results will impact their retirement plans more than market performance.

The song may remain the same regarding election and investment outcomes, but what seems different now is the political divide. Partisanship and political tribalism among Americans appear more intense these days. This widening political divide can create a sense of impending doom for investors who fear what may happen if their preferred candidate or political party doesn’t prevail at the ballot box.

Like the misperceptions of stock market performance, these biases are also largely incorrect. Things are never as bad as investors may think when they’re on the losing side. Conversely, things are never as good as investors may think when they’re winning.

Still, the emotions generated by election campaigns can darken investor perceptions. This effect was evident in our recent election survey, where we asked respondents about the likelihood of future economic events if the political party they least align with gains more power in the 2024 elections. Here’s what they said:

- 50% said “The cost of living will rise.”

- 34% said “Taxes will increase.”

- 34% said “The economy will enter a recession.”

Financial professionals may not be able to close the political divide, but they can help clients see through the emotional effects of the election and maintain focus on their financial goals. Many clients may benefit from the objective filter offered by financial professionals through unbiased advice.

Across the political spectrum, a majority of investors find value in sound financial guidance during a hotly contested election season. You can bring that calm, collected voice to your client conversations in the emotional weeks leading up to Election Day, and possibly in the weeks that follow as well.