06/05/2024 — The apparent disconnect between strength in the overall economy, as indicated by above-trend Gross Domestic Product (GDP) growth over the last year, and the dour mood among U.S. consumers has confounded market participants. According to a recent Nationwide Retirement Institute survey, around 8 in 10 consumers rate the U.S. economy as fair or poor to underscore this split.

Elevated interest rates, moderating wage gains, and dwindling savings should create a headwind for consumers and the economy. Yet, despite these headwinds, consumer spending numbers have defied gravity and exceeded expectations in recent years, casting doubt on the historical relationship between income and spending.

Reports from the first-quarter earnings season may offer some insight into the current state of U.S. consumers. Recent company commentary indicated that some consumer segments are beginning to show signs of fatigue while others show no apparent intention of slowing their spending. This begs the question: are specific U.S. consumers less sensitive to interest rates than others, potentially offsetting any material slowdown in economic growth?

As resilient as the current economic cycle has been from a GDP standpoint, pockets of weakness continue to percolate among different consumer cohorts. We can see this split in credit card balance data from the Federal Reserve Bank of New York; roughly one in seven (15.3%) Gen Z credit card borrowers have maxed out their credit cards, while just 4.8% of Boomers are at their credit card limits.

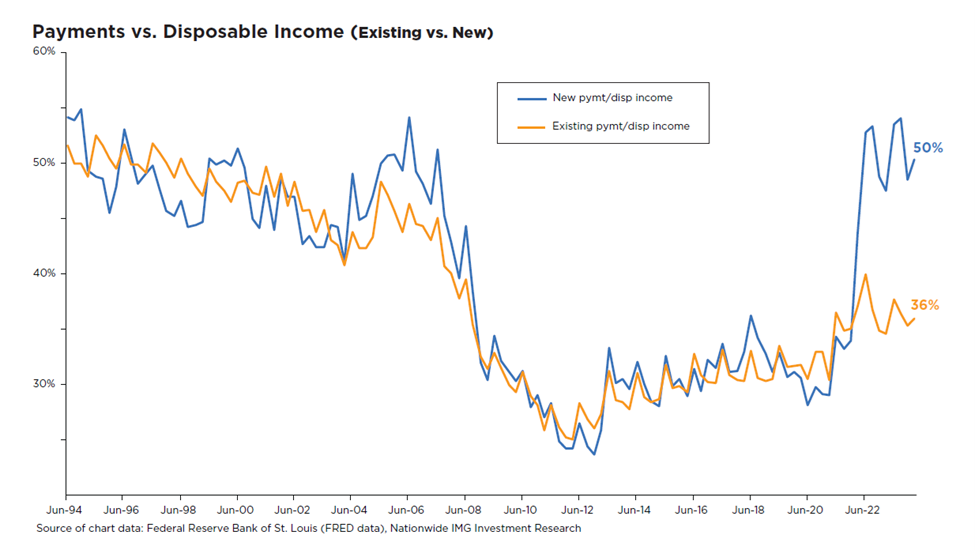

Using the pandemic recession 2020 as a starting point, the chart illustrates that generally, homeowners who took advantage of low rates to refinance their mortgages have much lower payments compared to their disposable incomes than first-time homebuyers who face much higher levels of rates. Please note that the existing payment line uses the average outstanding mortgage rate and average home value to calculate the monthly payment for outstanding mortgage debt compared to disposable personal income. In contrast, the new payment line uses the market rate on new mortgages and average home value compared to disposable personal income.

In other words, having a fixed, low payment produces a knock-on effect, blunting the impact of higher interest rates and spurring consumption toward discretionary spending. In summary, the discrepancy between a resilient consumer and above-trend growth for GDP likely masks a more nuanced undercurrent among different cohorts of the U.S. consumer and should be monitored by investors as the economic cycle evolves.