View the infographic

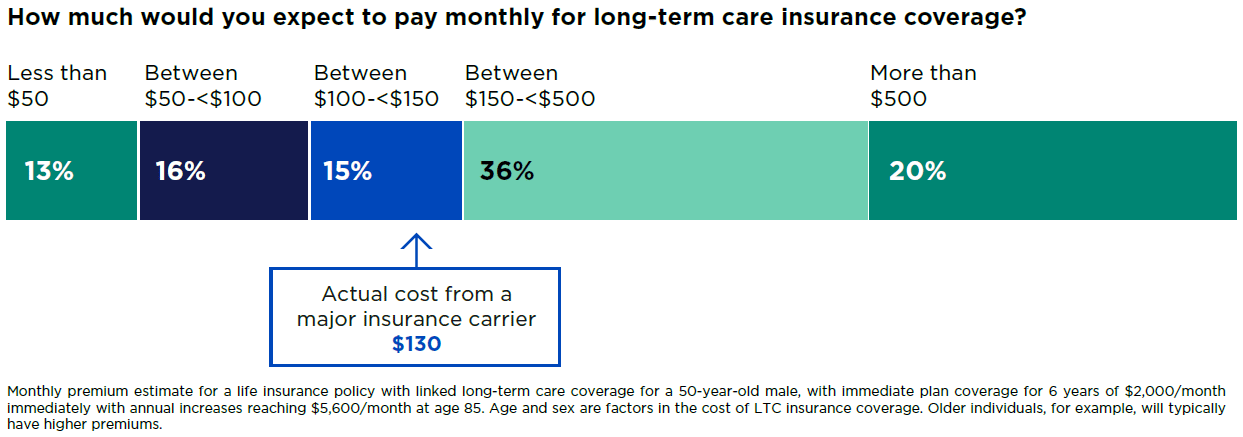

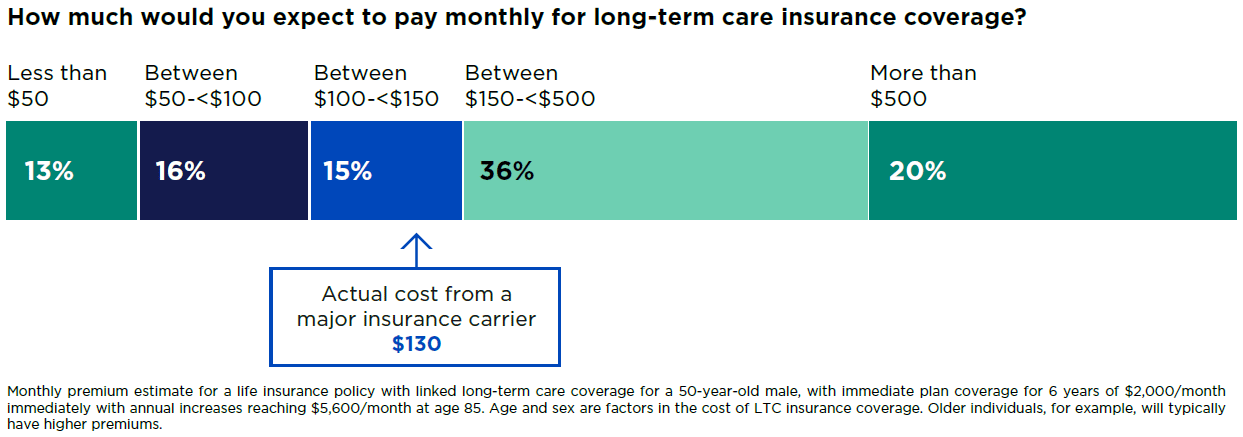

There is good news, though. When told the correct average price of $130/month for that specific plan, 40% of respondents were more willing to consider buying a similar plan for themselves. This points to an opportunity for you to help clear up the confusion by showing clients what their specific LTC insurance policy would actually cost.

Address clients’ worries about "being a burden"

Not surprisingly, most people want to receive care in their own homes as they age. They know, however, that this decision could put a burden on their family or friends.

Concern about that burden on family or friends are the top reasons why clients either bought or would consider buying LTC insurance coverage. Some of the reasons they specifically chose include:

- Avoiding being a financial burden (52%)

- Avoiding being a physical burden (51%)

- Avoiding being an emotional burden (40%)

- Reducing stress related to caregiving (40%)

Many people also have experience in being family caregivers themselves—confirming fears about the emotional, financial and career burdens involved. Among those who have act/acted as a caregiver for loved ones at home:

- On average, they spend/spent $338 per month on non-reimbursed care expenses—largely for food and personal items for the person they care for, and transportation

- More than a quarter (28%) aren’t prepared financially for current or potential caregiving responsibilities that could arise

- A little over two in five (43%) are afraid that caregiving expenses will keep them from ever retiring

Despite the challenges of caregiving (financial and otherwise), most people would still choose to be a caregiver for a loved one, even if it’s difficult. Sharing this information with your clients could open a valuable discussion about their LTC preferences, who will provide that care, the costs involved, and potential LTC insurance solutions.

Help from artificial intelligence is expected

Advancements in artificial intelligence (AI) could change the way people receive long-term care and reduce the financial strains placed on caregiving and aging. While almost one third of people (32%) don’t believe they will be able to afford long-term care in their home, over half in our survey (54%) expect that AI tools and robotics will be affordable for people like them to help with aspects of daily living later in life.

Americans anticipate AI tools could assist long-term caregiving in more ways than easing financial strain. Most people in our survey said they expect AI-based tools in the future to be helpful in improving quality of life and managing some administrative aspects of care.

AI-driven tools may prove to be useful in alerting caregivers that a loved one is suffering a medical emergency, or in helping them manage medications and appointments. That helps explain why some caregivers expect AI to help extend the life of the person they care for by an additional seven years.

Encourage clients to start planning for long-term care

People aged 59 and older with $75K+ household income have unique perspectives on long-term care. The top advice they would give their younger selves about planning for LTC is to start to save (47%) and plan (36%) earlier.

As a trusted financial professional, you have a unique opportunity to help your clients act on that advice. By initiating the conversation, you can help them:

- Recognize the importance of planning for LTC

- Understand the cost of LTC and LTC insurance

- Consider their preferences and concerns related to care as they age

- Make a plan that will fit their goals and their budget

It may seem daunting to "break the ice" with clients in talking about long-term care planning. One way to ease into the discussion is to ask clients how their parents and other family members are doing. You can also relate your own personal experiences with older parents and other relatives, or share stories from other clients (keeping any personally identifiable details to yourself, of course.)

The most important step you can take as a financial professional is to proactively communicate with clients, ensure they understand the costs, and develop a long-term care plan that accounts for their anticipated needs, as well as those of their loved ones.