View the infographic

LTC confidence exceeds knowledge

First, clients must be ready and open to have this conversation. More often than not, these conversations are happening at home among family members. Half of all respondents in our survey said they have discussed LTC costs with their spouses, 18% with their children, and 11% with their parents. Those numbers are encouraging, although only 18% of respondents have talked with a financial professional about LTC costs. In fact, 27% of people haven’t talked to anyone about long-term care.

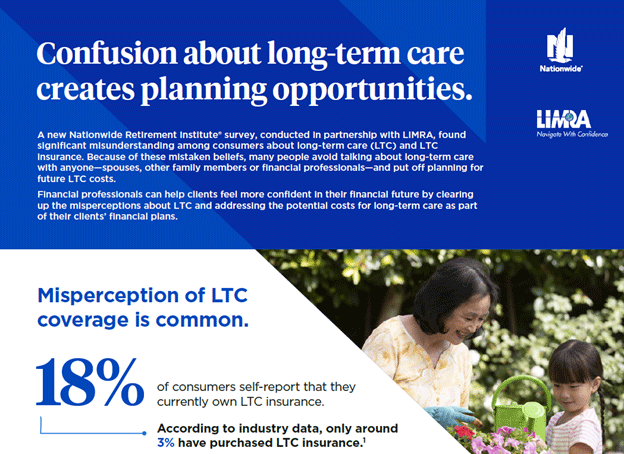

Despite some confusion surrounding long-term care, consumers feel pretty confident about knowing how to cover LTC costs. In our survey, almost half of consumers (49%) feel somewhat or very knowledgeable about long-term care insurance.

However, when a client says they’re already covered for these potential costs, don’t assume they’re correct. Many won’t be. A simple definition of what long-term care is and what LTC insurance covers can be an easy and effective way to start the conversation.

The price of aging in place

When you start talking with clients about long-term care, you may discover that some clients have new or surprising perspectives that may challenge the conventional wisdom about LTC. As one example, the growing interest in artificial intelligence (AI) is reaching the health care industry (as it is with nearly all industries these days.) AI holds the promise of breakthroughs in medical research, which could result in more people living longer, healthier lives.

Consumers seem accepting of the role AI may play in providing care later in life. One-third of those polled in our survey think they’ll receive home-based long-term care from AI and robots—although the majority of people (65% in our survey) still prefer human touch when it comes to providing health care.

Understandably, most people want to receive LTC if needed in their homes. Our survey confirmed this consumer preference; 75% said they would prefer home-based care if they ever needed long-term care.

However, there are expenses for home-based LTC that clients should be aware of and plan for. In-home long-term care may require additional costs for homeowners to modify their existing residences such as adding ramps, widening doorways, or updating bathrooms, for example.

When we asked survey respondents more about home-based care, 34% said their current residence is not set up or suitable for aging in place. In addition, 43% are concerned that the city or neighborhood where they currently live won’t be suitable for aging in place. But many clients may not be aware that long-term care can be used to help provide both formal and informal care in the home, which can prove valuable for helping people live in their homes or preferred area for longer.

Aging in place may not always be possible for surviving spouses or clients who are single. Home-based LTC will likely not be feasible for clients needing extensive or specialized care. While aging in place is still preferred, clients shouldn’t count on it. That makes long-term care insurance all the more important as part of a client’s comprehensive financial plan.

Where to start LTC conversations

Despite the confusion about what long-term care is, it’s encouraging to see from our survey that the majority of people recognize the importance of LTC insurance. This can be the starting point as you connect with clients to help them plan for these potential expenses.

As you consider which clients may be more interested in a long-term care planning conversation, there are some generational differences to be aware of. Among LTC-informed survey respondents (after reading a definition of what long-term care is), 68% of those who fall in Generation X (around the ages of 42-57) said having LTC insurance was either very or somewhat important—more than the general population.

As this age group is getting closer to retirement, many Gen Xers may be scrutinizing their current savings and thinking about what their retirement may look like, including the potential for needing long-term care. This group is also more likely to be in a place where they’re ready to make financial decisions that can help secure their future.

Even though most people are turning to those closest to them to talk about this sensitive subject, you still have an important role to play in these conversations. In our survey, 30% of respondents told us they would be open to discussing LTC costs with a financial professional in the future.

Because the need for LTC is a personal topic that comes with many emotional issues, your voice can be the objective view that many clients need to make informed decisions for themselves, their spouses, or their family members.