View the infographic

Retirement fears leave investors looking for answers

Because the internet is easy to access for nearly everyone, it makes sense that investors go there first to seek answers to their financial questions. But before we get into the challenges of parsing out money misinformation, we should consider what’s driving investors to know more.

The demand for financial information comes at a time when many people are feeling increasingly stressed about their personal finances. Financial planning struggles can come from different sources—debt overload, lack of savings, and high taxes, for example. Being prepared for retirement is one of the more common concerns.

Many investors report feeling less confident and more uncertain about their financial futures, but we wanted to know how they’re feeling in the present day. In our Advisor Authority survey, we asked investors about any changes they’ve made to their retirement plans due to the financial stressors they’ve experienced.

About four in ten (41%) non-retired investors said that if they retired in the next 12 months they would continue to work in some capacity to supplement their essential income. More than one in four non-retired investors said they would likely need to work in retirement due to inadequate savings.

Additionally, 19% of non-retired investors have changed their retirement plans in the last 12 months and are currently planning to retire later than planned. That’s almost double the number of non-retired investors who said they have changed their plans in the last 12 months to retire earlier than planned (10%).

Financial stress can quickly compound to leave investors wary, confused, and vulnerable to making bad decisions with their money and savings. So, it’s understandable they’d turn to online sources to get more informed and make better financial decisions. However, the prevalence of financial misinformation online makes it likely investors run into trouble by following bad advice.

Financial misinformation is easy to find

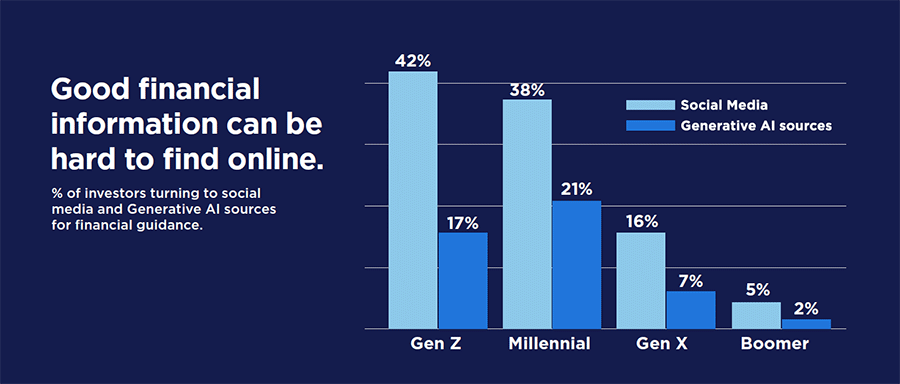

In recent years, social media platforms have emerged as the go-to source for getting information on nearly every topic, not just for money and finances. On these platforms, investors can get #financetips to help them increase their #financialliteracy about #retirementplanning, so they can #invest their #money for #financialfreedom. Additionally, on social media, they can get money tips from a growing army of "fin-fluencers" – everyday people offering financial advice to anyone who listens.

Generally, it’s investors from younger generations who are more inclined to seek out financial information on these social platforms. That’s not surprising given that many Millennial and Gen Z investors grew up online. Our survey confirmed this trend; nearly two-fifths of Gen Z (42%) and 38% of Millennial investors have turned to social media for financial guidance, with usage dropping significantly among older generations.