Simplify Medicare for your clients

woman showing a paper to a man and woman

Our white paper, "Medicare Explained: Answers to Client Questions," can help you expand your Medicare knowledge, deepen client loyalty and set yourself apart from competitors.

Medicare will likely be one of your clients’ biggest expenses, and it will probably last over the longest period. It can also be one of the most confusing costs in retirement.

Clients want and need help with Medicare. In fact, most respondents to a Nationwide Retirement Institute® study (72%)1 said if a financial professional couldn’t help them navigate their Medicare choices, they’d probably switch to one who could.

Key client questions center around eligibility, timing, coverage options and especially costs.

In general, Medicare is available to individuals who are 65 or older as well as those with a disability, end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), regardless of age. People receiving retirement benefits from Social Security (or the Railroad Retirement Board) are also eligible for Medicare.

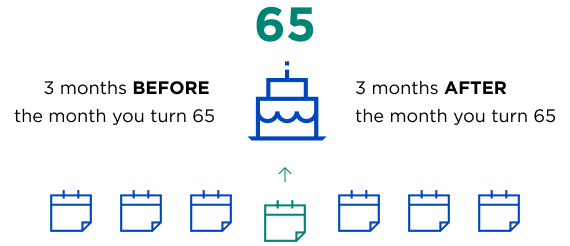

In general, there are three enrollment periods for Medicare:

- Initial Enrollment Period (IEP), which begins 3 months before an individual’s 65th birthday month and ends 3 months after their birthday month

- General Enrollment Period (GEP), which runs from January 1 to March 31 each year, with coverage starting on July 1, but may involve late penalties

- Special Enrollment Period (SEP), which allows those with employer-provided group health coverage past age 65 to enroll anytime while still employed or up to 8 months after their employment or coverage ends without penalty

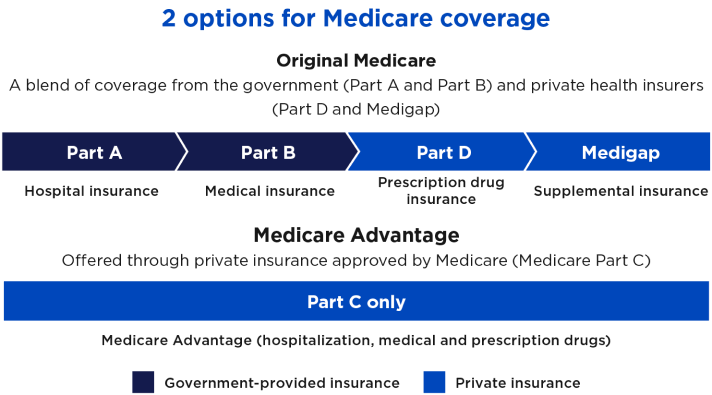

Medicare comes in parts, each with specifically targeted benefits. Individuals can purchase either Original Medicare, which includes Parts A, B, D and Medigap supplemental coverage, or a Medicare Advantage plan, which includes Part C (a combination of everything in Original Medicare).2

How to pay for Medicare coverage

Medicare recipients pay monthly premiums. Those who also collect Social Security benefits enjoy an extra convenience: Their Part B premiums are deducted from their Social Security benefit checks.

Those not collecting Social Security benefits must self-pay with their credit or debit card, via debit from their bank account or by mail with a payment coupon.

Planning for out-of-pocket expenses

Even those covered by Medicare, Medigap and other plans still have to pay premiums, co-pays, co-insurance and potentially other out-of-pocket costs. Those costs add up over time. You can help clients plan for those expenses now so that they can be better prepared when those costs arise. Strategies to consider may include:

- Leveraging health savings accounts (HSAs)

- Borrowing or withdrawing from permanent life insurance

- Regulating withdrawals from taxable accounts

- Converting traditional IRA funds into a Roth IRA

- Planning charitable contributions

Tips for educating clients

When advising clients on Medicare, the goal is to simplify the complex. For a topic as in-depth and wide-ranging as Medicare, that’s no easy task. Consider these tactics to ensure that your communication is clear, accurate and useful.

Keep it simple. Avoid jargon and technical terms. Use plain language to explain Medicare options and benefits.

Use short paragraphs and sentences. Breaking down information into small, digestible parts can help clients grasp the essentials without feeling overwhelmed.

Share information from trusted resources. Reliable sources such as the Nationwide Retirement Institute, the official Medicare website and the official U.S. Centers for Medicare & Medicaid Services website offer invaluable information.

Encourage clients to complete a health care cost assessment. Use the results from your client’s assessment report as a planning opportunity. Discuss reducing modified adjusted gross income as they get closer to retirement.

Use visual aids. Graphs, charts and infographics can transform complex data into understandable visuals.

Offer personalized examples. Such examples help clients understand the practical application of the information, making it easier for them to make informed decisions.

Follow up. Medicare information can be a lot to take in at once. Following up consistently can help ensure that clients understand the information, and it gives them a chance to ask questions.

Solidify clients' loyalty and respect

The overwhelming majority (85%) of adults surveyed agree that managing health care costs should be a part of a personal financial plan.3 But considering that Medicare can be very complex and multifaceted, making decisions about the program can be intimidating for clients.

Simplify the Medicare discussion with your clients using these resources

You can further earn clients’ appreciation, loyalty and respect by helping them understand the details and view their options from different perspectives.

Start by reading our white paper, "Medicare Explained: Answers to Client Questions."

two women walking down a sidewalk

Nationwide is here to support you.

For more information on the topics of health care and wealth transfer, contact your Nationwide wholesaler. For additional consultation, contact the Nationwide Retirement Institute Planning Team at 1-877-245-0763.

1 "The Nationwide Retirement Institute Health Care Cost in Retirement Consumer Survey," conducted by The Harris Poll on behalf of Nationwide Retirement Institute (October 2023).

2 "Parts of Medicare," U.S. Centers for Medicare and Medicaid Services, medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare (accessed July 15, 2024).

3 "The Nationwide Retirement Institute® 2023 Health Care Costs in Retirement Survey," (October 2023).

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.

Related topics & resources