Home insurance resources

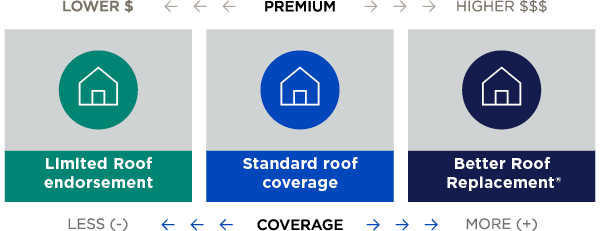

What are your roof coverage options?

Regardless of your coverage, it’s important to let your agent know if you replace your roof so they can update your policy.

Roof coverage considerations

Here are a few factors to consider as you evaluate roof coverage options.

Always talk with your agent about the best fit for your needs.

When it comes to coverage for your roof, what’s more important: coverage or cost? Or something in between?

Do you live in an area with high wind/hail risks?

Do you have an emergency fund or savings that could cover the cost of a roof replacement if needed?