This election season, keep calm and invest on

Is the upcoming presidential election making you think twice about your investment strategy? You're in good company. Our 10th Annual Advisor Authority study powered by the Nationwide Retirement Institute® found that 55% of investors believe U.S. federal election results will impact their retirement plans and investment portfolios more than market performance—a 10% jump from last year. But here's a timely reminder: don't let your emotions hijack your investing goals.

In today's highly charged political climate, it's easy to get swept up in the moment. While elections can stir up strong feelings, they shouldn't be the driving force behind your investment decisions. The reality is, election outcomes, like most external forces, have little long-term effect on the financial markets. That’s one of the many reasons why it’s important to focus instead on investing fundamentals – the results achieved by businesses and the economy – and stay true to your long-term financial goals, no matter who’s in the White House. Maintaining perspective during times like these can be challenging – a financial professional can provide valuable guidance and help you stay on track with your investment and retirement planning strategies.

The pitfalls of investing under political influence

Election years, particularly federal and presidential campaigns, tend to ignite political tribalism – a phenomenon where people with strong political beliefs may self-segregate into “tribes” of like-minded individuals. However, investors under the influence of political tribalism may perceive a connection between politics and investing that in reality doesn’t exist, causing them to make misguided or emotionally driven decisions or take unnecessary risks with their investment and retirement portfolio management strategy. This can manifest in several ways:

- Overconfidence: Investors may take on excessive risk when their party is in office.

- Excessive pessimism: Those whose party is out of power might become overly cautious, potentially missing out on market gains or recoveries.

- Confirmation bias: The tendency to link political victories with market performance, even when there's no real correlation. These investors believe that their deeply held political views translate to financial gain, although that’s typically not the case.

It's crucial to recognize the emotional impact of elections and political tribalism and strive to tune out the pessimistic "noise." Keep in mind, election results have had little historical impact on long-term investment returns, therefore, try not to let political headlines sway your investment and financial decisions. Here’s where a financial professional can offer support by providing unbiased advice and helping you navigate through politically charged market environments.

Tune out politics and focus on fundamentals

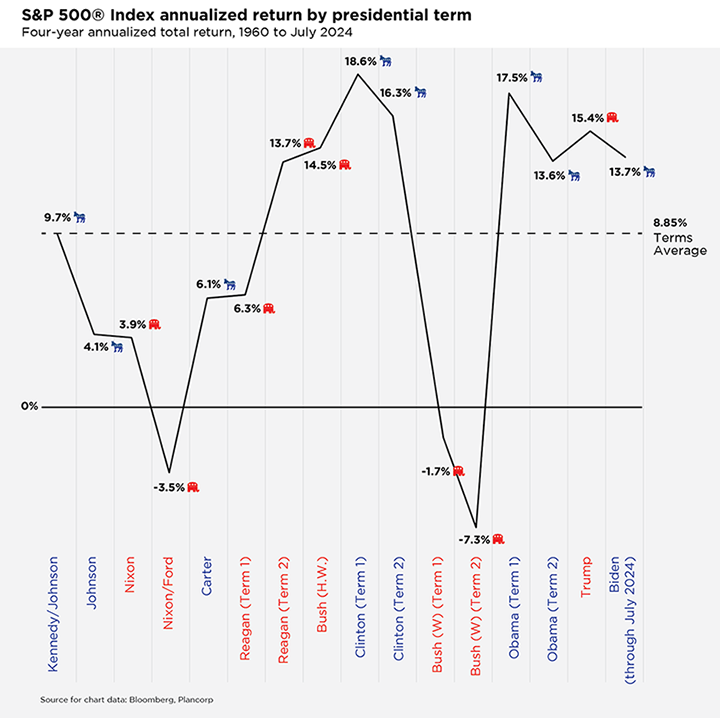

Despite common misconceptions, historical data shows that stock returns have been strong under both Democratic and Republican administrations. In fact, as the chart below shows, one-party’s control has shown no significant effect on long-term market returns.

The truth is, historical data shows that the stock market’s long-term trajectory is influenced more by fundamental economic factors than by which party holds power. And historically, the market has experienced more up years than down, regardless of political party.

For example, look at the average annual stock market returns (as represented by the S&P 500® Index) for the last half-century. The average yearly return of the S&P 500 over the last 50 years is 11.86%, as of the end of July 2024 (assuming dividends are reinvested)1. Therefore, maintaining a focus on sound investment principles and long-term strategies is crucial, rather than reacting impulsively to political events.

Key investing fundamentals to watch

The stock market’s indifference to political party lines is evident: historically, investors who stayed invested outperformed those who only invested when their preferred party was in power, as per data from Strategas. The bottom line is that letting political beliefs dictate your investment strategy has historically led to underperformance, while focusing on long-term fundamentals and staying invested has proven more successful. Rather than fixating on your political beliefs, stay focused on the fundamental drivers of market performance. Fundamentals could include factors such as:

- Company earnings: These are the primary driver of equity market returns.

- Revenue growth: This is a key indicator of a company's health and potential as an investment opportunity.

- Economic indicators: Pay attention to fundamental indicators such as the Index of Leading Economic Indicators (LEI), which often include things like unemployment claims, stock prices, and consumer confidence metrics. Shifts in these indicators can signal short-term changes in the broader economy.

Keeping an eye on fundamentals can also help you maintain a long-term perspective. In other words, don’t try to time your investing strategy around key events, such as elections. Doing so may cause you to miss out on critical opportunities for investment gains. You can help mitigate the short-term, election related market ups and downs by staying focused on time-tested investing principles such as maintaining a diversified portfolio, staying invested for the long term, and seeking financial professional guidance.

Professional guidance: Your anchor in turbulent times

Don't let election season jitters derail your financial future. Consult with a financial professional who can help you avoid making hasty decisions and stay on track with your long-term investment strategy. A fiduciary financial advisor can provide tailored guidance that accounts for your unique financial situation and goals, helping to keep your investment decisions based on sound financial principles rather than politically charged emotions.

A qualified financial professional can:

- Provide objective analysis of market trends and economic indicators.

- Help you maintain a long-term perspective on your investment and retirement goals.

- Offer guidance on navigating market volatility, including around election season.

As you focus on making progress towards your financial goals throughout your life, remember, elections come and go. By focusing on the fundamentals and seeking professional guidance, you can better navigate the temporary turmoil of election season and support your long-term financial goals.

1 Average is based on monthly average prices, not a specific day. For example, July 1974 to July 2024 for the 50-year average. Since it is a monthly average, you could also think of the time frame as roughly mid-July to mid-July (12 months) as opposed to January 1 to December 31 (12 months). Source: Tradethatswing.com, July 2024.

Survey source: Tenth Annual Advisor Authority study, powered by Nationwide Retirement Institute®

Survey methodology: The Harris Poll, on behalf of Nationwide, conducted an online survey in the U. S. among 610 advisors and financial professionals and 2,496 investors ages 18+ with investable assets (IA) of $10K+, August 26-September 13, 2024.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data for advisors is accurate to within + 4.0 percentage points and for investors the sample data is accurate to within + 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed populations of interest. The sample data for the subset of pre-retiree investors age 55-65 who are not retired is accurate to within + 6.7 percentage points using a 95% confidence level.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors LLC. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.