Loading...

Social Security 360 Analyzer®

The Nationwide Social Security 360 Analyzer® tool helps you provide clients with the personalized guidance they’re seeking. With our resources you can help answer their key question as they approach retirement: When should I take my Social Security benefits?

Why Social Security optimization planning matters

The age at which clients start claiming Social Security can have a huge impact on the size of their benefit. Clients can file as early as age 62, but they would receive a reduced monthly benefit compared with the amount they’d receive at full retirement age. Or they could delay filing up to age 70 to increase their monthly benefit by as much as 80%.1

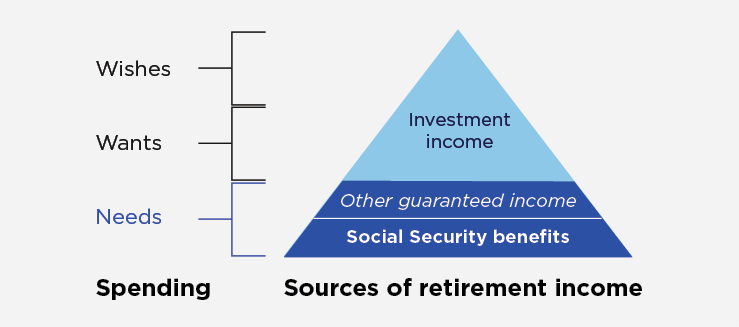

A guaranteed income floor

Social Security benefits are guaranteed income, so they provide an income floor in retirement. Benefits replace, by many estimates, about 30% to 40%2 of a retiree’s pre-retirement income from wages, with the remaining 60% to 70% of their monthly “paycheck” often coming from savings.