Loading...

Health care costs today affect wealth transfer tomorrow

Preparing for health care and long-term care costs can help clients avoid spending down assets and preserve wealth for the next generation.

George W. Schein, JD, ChFC®, CLU®

Technical Director, Advanced Consulting Group

Download PDF

Key topics

- People are living longer in retirement, leading to more years of health care expenses that could deplete savings

- Though a great generational wealth transfer is coming, health care spending could diminish what loved ones receive

- Planning ahead for expenses such as long-term care can protect portfolios and preserve more wealth for family members

Now and then: Comparing financial lives

- Now and then: Comparing financial lives

- Assessing the risk of health care costs in retirement

- Planning goals for specific life stages

As people enter their retirement years, their financial priorities are likely to shift. The beginning of retirement usually brings a greater focus on wealth preservation, as retirees seek to maintain their desired lifestyles and make their money last for as long as they may need it. Also at this stage, clients start to think more about how the transfer of their wealth may provide for the future financial security of their children, grandchildren and other loved ones.

Most older clients with savings to pass along are likely to want their wealth used effectively by those who inherit it. When the asset transfer is significant, it can potentially create a source of family wealth that endures for several generations. Moreover, the children and grandchildren of these clients may be counting on the transfer of family wealth to help them reach a level of financial security for the future.

A primary risk for any wealth transfer plan is the depletion of savings over the course of a long retirement. One of the biggest factors that drives wealth depletion during retirement is health care costs, including rising out-of-pocket costs for medical treatment and the probability of needing long-term care later in life. These potentially high expenses increase the likelihood that most of a client’s life savings could be wiped out during their lifetime, leaving little or nothing to transfer to their children or

other beneficiaries.

Planning ahead for retirement health care and long-term care often raises sensitive issues that clients and families find difficult to discuss. But when clients don’t discuss these issues or fail to convey their wishes to family members, these decisions are deferred to younger generations to solve in the future, when time and options are likely to be limited. Moreover, your client may not want their children to make such decisions on their behalf. A better approach is to ensure that a client's existing financial plan proactively accounts for these costs. Encourage them to include their family members so that their wishes are clear. Those involved should have a keen grasp of the details of the plan, especially of ones that impact them.

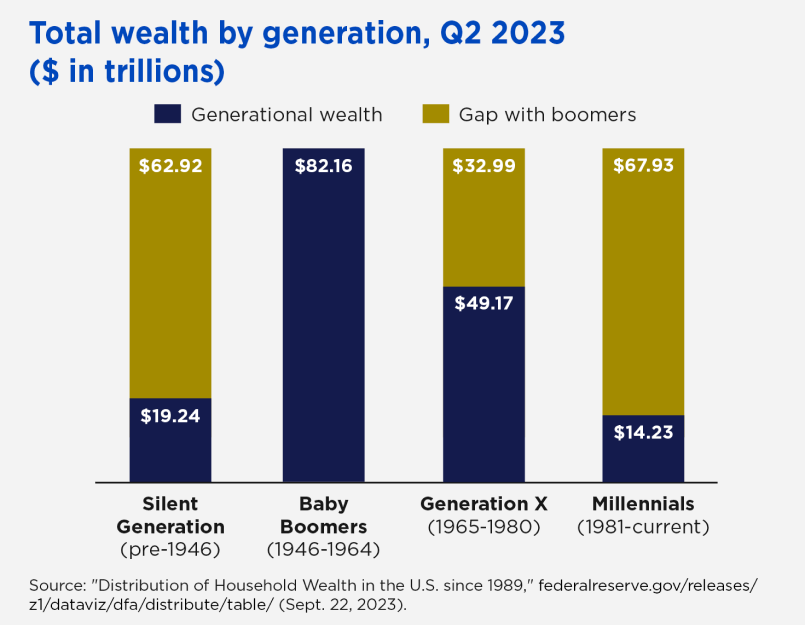

The wealth gap between generations

There is a significant gap in accumulated wealth between older and younger generations. Among the older generations, baby boomers (born between 1946 and 1964) control just over half of the wealth in the U.S., over eight times the current wealth of millennials (born after 1981). Generation X (born between 1965 and 1980) is in the middle, having accumulated some wealth but now considered a “sandwich generation.”

Of course, because older generations have had more years to earn income and build savings, significant differences in accumulated wealth are expected. The wealth gap will narrow naturally as older generations spend down their wealth during retirement and younger generations build theirs through continued saving and investing.

However, millennials may be unique among younger generations in not having reached financial milestones at the same age as older generations, and many are struggling to achieve the same level of financial security. (Review the table below.) It’s true that millennials and younger generations have come of age during times of tremendous economic upheaval (e.g., the global financial crisis in 2008, COVID-19 pandemic). The financial fallout from these experiences has contributed to widening the wealth gap. But younger generations today are also carrying more debt and struggling with housing affordability — both factors that present significant obstacles to achieving long-term financial security.

Now and then: Comparing financial lives in 1990 and 2022

|

1990 |

2022 |

Increases |

| Net compensation1 |

$21,027 |

$63,795 |

3.28% average yearly increase |

| Price of medical care service2 |

$100 |

$367.42 |

4.15% yearly increase |

| Median home price3 |

$123,900 |

$429,000 |

246% increase |

| College tuition (public 4-year school)4 |

$5,243 |

$21,878 |

317% increase |

| College debt4 |

$9,320

11% of population |

$37,750

33% of population |

346% increase

10.8% average increase |

As the children of boomer parents, many Gen Xers and millennials stand to inherit a significant share of boomers’ accumulated wealth. This could potentially be the largest transfer of wealth in U.S. history — and it could also help many millennials catch up on their wealth accumulation goals.

However, the potential for retirees in older generations to spend down their wealth, specifically on health care and long-term care costs, poses a substantial risk for younger generations who may be counting on inheritances to help them reach financial security. Contributing to this risk is the fact that increases in health care costs over time have far outpaced both the overall rate of inflation as well as wage gains. This means that over a long retirement, health care cost inflation can become a significant driver of wealth depletion. As a result, the hoped-for transfer of accumulated wealth from boomer parents to their millennial and Gen X children may ultimately end up in the medical system, instead of helping to narrow the existing generational wealth gap.

Assessing the risk of health care costs in retirement

Clients often overlook or underestimate how much they may pay for health care in retirement. In addition to rising costs of living in general, longer life expectancies paired with the large increases in health care costs mean that health care consumes more of a retiree's income and savings as they age, requiring a higher amount of their assets be directed toward paying for medical care and insurance premiums.

Many people who have yet to retire believe their employer-provided health insurance coverage will continue into retirement to help cover these costs (in most cases, it won’t) or assume Medicare will cover all of these expenses (it won’t). They may be surprised to find out upon reaching retirement how much of these costs, premiums and co-pays they have to pay out of their own pockets. For the average 65-year-old retired couple, out-of-pocket health care costs over the course of retirement could reach as much as $325,000.5 This spending can become a significant drain on a client’s accumulated wealth, if it’s not accounted for in their financial plans.

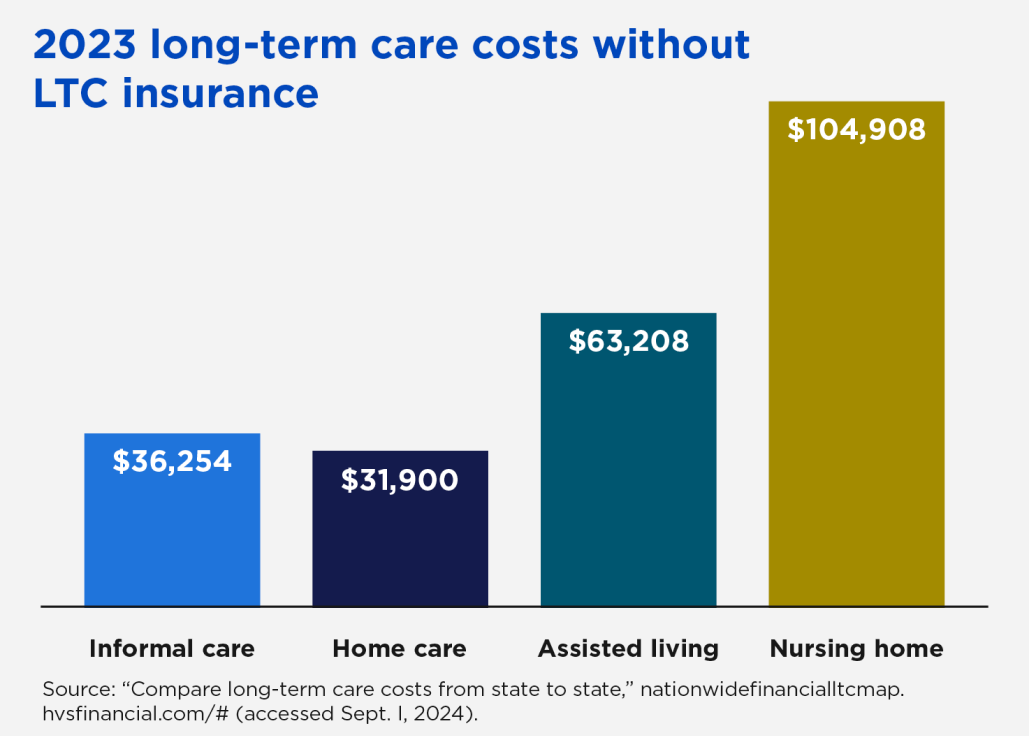

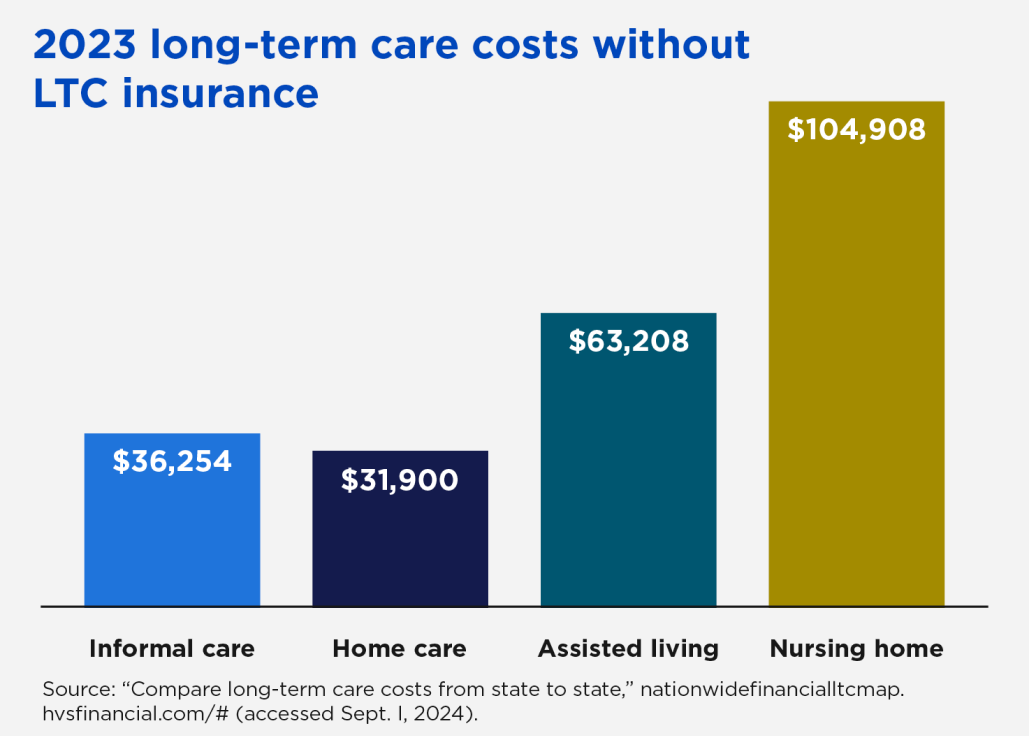

Clients must also assess the financial and emotional costs of needing some type of long-term care in retirement. If long-term care is required, these costs can be financially significant to a retiree and their family. It’s important to clients to understand that long-term care isn’t limited to inpatient nursing home care. Long-term care can take a variety of forms, including in-home care provided by a spouse or family member. This informal care may be attractive from a financial perspective, but care providers may bear the financial risks of lost employment income when their time is devoted to caregiving, in addition to the emotional stress of the responsibility.

When considering the potential for long-term care costs, many older people and their families may opt to self-fund these expenses from accumulated wealth or by selling assets such as the family home. While self-funding is an option, clients and families should assess the impact these out-of-pocket expenses could have on estate planning. Long-term care is often open-ended, which means there may be no limit to the amount of expenses incurred. And remember, if a third-party caregiver is hired, long-term care costs vary widely from state to state, so where a client lives at the time that they need long-term care can have a big impact on their entire financial portfolio.

Expand all

- Build wealth for the long term with a suitable strategy to manage risk.

- Develop good savings habits as early as possible (for example, enrolling in workplace retirement plans).

- Take advantage of savings opportunities in health savings accounts (HSAs), which can be used for short- and long-term health care needs, including in retirement.

- Integrate health care costs and the potential for long-term care into a client’s financial plan.

- Consider planning options designed for retirement needs, such as consistent income with variable or fixed annuities.

- Transition from wealth accumulation to preservation with strategies to help counter the risks of inflation, higher interest rates, market volatility and taxation.

- Use more liquid assets or guaranteed income sources to fund immediate and short-term spending needs.

- Designate longer-term assets that can remain untouched in the early years of retirement and are able to compound growth.

- Plan for the costs of extended care, regardless of whether the plan is for in-home care from family members or professional care in a long-term care facility.

Ensure that estate plans and health care directives are in place to facilitate a smooth wealth transfer process.

Document health care directives and power-of-attorney designations to avoid confusion about financial or health care decisions if a client is unable to do so on their own.

Bringing the family together

Family members across generations all have a stake in the decisions made around wealth transfer planning, including plans for health care, long-term care and their related costs. As a financial professional, one option you may consider to help older clients and their families make these decisions is to host a family meeting, allowing all generations to get on the same page about future wealth transfer plans and health care preferences, well before any decisions need to be made.

During the family discussion, older clients may value the opportunity to voice their wishes for their inherited wealth to their children or to other loved ones, as well as their feelings on health care decisions later in life. This part of the conversation can focus on choices between in-home and inpatient care and critical end-of-life decisions. Family members can also discuss who could step in as a care provider when needed and who could assume power-of-attorney responsibilities for medical decisions when an older parent is unable to decide for themselves.

In preparing for such a family meeting for clients, financial professionals must recognize that any discussion with clients on wealth transfer and health care later in life will be difficult. Aging brings many challenges, and talking about one's own mortality can be intimidating and emotional for some clients. These topics are personal and require sensitivity. Yet your clients may find it valuable to have an honest discussion about these decisions, which will have a significant financial impact, with an objective third party in the room, such as a trusted financial professional.

An opportunity for business development

Assets often leave a financial advisory practice when wealth transfer occurs after a client’s death. In many cases, no relationship exists between the financial professional and the client’s children or other beneficiaries. So hosting a family meeting presents the opportunity for financial professionals to start relationships with a client’s children and family members of younger generations.

Family meetings are a good time for a financial professional to introduce themselves and offer to continue managing family wealth according to the other family members' plans and wishes. Helping your clients extend their inherited wealth is an opportunity to demonstrate empathy and build trust, while fostering opportunities to work with the next generation going forward.

Related topics & resources

Older couple walking through forest together

Nationwide CareMatters®

This single-life coverage is for clients who are primarily looking for long-term care coverage and want to be able to recover their costs if they never need care.

[1] "Average Wage Index (AWI)," ssa.gov/oact/cola/awidevelop.html (accessed Sept. 1, 2024)

[2] "Prices for Medical Care Services, 1935-2024 ($20)," officialdata.org/medical-care-services/price-inflation (accessed Sept.3, 2024).

[3] " Average Sales Price of Houses Sold for the United States," fred.stlouisfed.org/series/ASPUS (July 24, 2024).

[4] "Average Cost of College by Year," Melanie Hanson, educationdata.org/average-cost-of-college-by-year (Sept. 9, 2024).

[5] "A Bit of Good News During the Pandemic: Savings Medicare Beneficiaries Need for Health Expenses Decrease in 2020," Paul Fronstin and Jack VanDerhei, Employee Benefit Research Institute (May 28, 2020).

This information is general in nature and is not intended to be tax, legal, accounting or other professional advice. Neither Nationwide nor its representatives give legal or tax advice. Please have your clients consult with their attorney or tax advisor for answers to their specific tax questions.