Loading...

A new perspective on health savings accounts (HSAs)

Learn how HSAs can help employees save for health care costs in retirement.

Download PDF

- How HSAs function

- HSA scenarios

- Advantages

Executive summary

The benefits landscape in the U.S. is rapidly changing, along with the value and delivery of those benefits. With millions of baby boomers retiring each year — and millennials having surpassed baby boomers as the nation’s largest living adult generation1 — the issues of which benefits are most critical and how these benefits are delivered, used and deployed are taking on new meaning. Those closer to retirement often ask whether they have enough savings and question what their health care needs will be in retirement.

Younger workers are also mindful of their prospects in retirement and have placed a premium on being in the best position possible later in their career. Two-thirds of millennials and Gen X adults are planning for retirement, as is 42% of Gen Z population.2

What these seemingly discrete parts of our working population have in common is that all have an opportunity for greater control over one of the biggest determinants of retirement success: their financing and consumption of health care today, tomorrow and well into the future. Given this factor and many others, we can understand the focus on health care costs in retirement and the need to save and invest for those costs today.

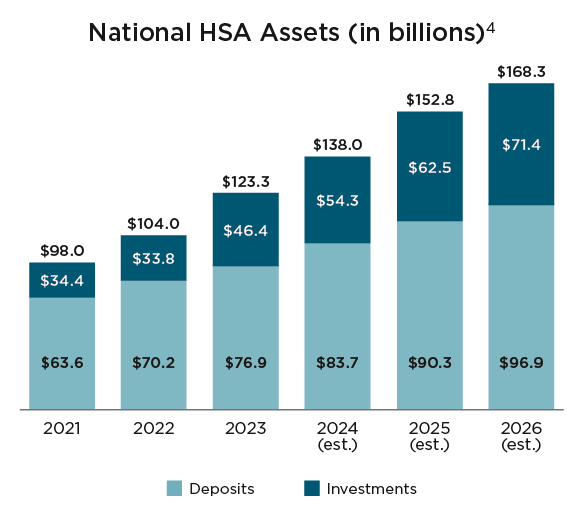

Health care costs in retirement are high, but there are ways to save more effectively. Health savings accounts (HSAs) create a method for people to save on a tax-free basis for health care costs. HSAs are growing rapidly.

The inclusion of an HSA, in addition to more traditional savings and investment vehicles, could be another avenue to solidify success not only in retirement but throughout the entirety of a prosperous career.

How HSAs function

A health savings account is a tax-favored vehicle that works with an HSA-qualified high-deductible health insurance plan. It allows employees to contribute part of their earnings directly into an HSA on a pretax basis during their working years before they turn age 65. In turn, the account can be used for qualified medical expenses on a tax-free basis.

Despite being available to the public since 2004,5 many people are still unfamiliar with HSAs and how they work. One reason for this is that after HSAs became available, employers were slow to adopt high-deductible health plans for their employees, in which enrollment is required before someone is able to contribute to an HSA. However, times have changed.

Taxation and penalties

- Withdrawals nonqualified expenses are subject to taxation plus a 20% penalty

- The penalty is waived when an individual:

- Is 65 or older

- Is disabled

- Has passed away during the year

IRS contribution limits (2025)

- Individual: $4,300

- Family: $8,550

- Catch-up, 55 years and older: $1,000; spousal catch-up of $1,000 as well (if placed in a separate HSA under their name)

- Contributions can be made up to April 15 of the following year, provided the account was open and qualified in the previous year (similar to IRAs)

HSA contribution eligibility

- Must participate in a high-deductible health WITH plan (HDHP)

- Not covered by a spouse’s or other person’s non-HDHP, including a spouse’s or other person’s general health flexible spending account (FSA) or health reimbursement account (HRA)

- Not claimed as a dependent on another person’s tax return

- Not enrolled in Medicare

How to use an HSA

Qualified expenses include:

- Most health care-related expenses, as described in IRS Publication 502, including:

- Medicare premiums for Parts B, C and D (but not Medigap policies) and other health care expenses for individuals age 65 or older

- Long-term care insurance

- COBRA coverage while on unemployment

What you can’t use it for:

- Vitamins and supplements for general health and well-being, gym or fitness club memberships or dues

HSAs are much more than a tax-preferred checking account for current medical expenses. While HSAs are useful for current medical expenses, their flexibility and features mean they are useful for long-term savings as well. As shown in the following scenarios, an HSA can be used to accomplish a variety of objectives. These include:

- Serving as a savings and investment vehicle for health care costs in retirement

- Funding current expenses while keeping future needs in mind

- Offering immediate funding of health care and insurance expenses in a tax-efficient manner

Key features of HSAs

HSAs create three types of possible tax benefits: pretax contributions, tax-free growth and tax-free distributions. Let’s check out each benefit:

- Pretax contributions

- Funded with pretax employer and employee contributions

- Lowers current-year taxes by reducing taxable income

- Tax-free growth

- Investments held in the HSA can grow on a tax-deferred basis, much like an IRA

- Tax-free distribution

- Distributions for qualified health care expenses are tax free*

- Withdrawals after age 65 that are not used for qualified medical expenses are subject to ordinary income tax, but are not subject to any tax penalty

- The account transfers to a spouse upon death if the spouse is the designated beneficiary

* HSAs are not taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states, but not all, recognize HSA funds as tax free. Please consult a tax advisor regarding your state’s specific rules.

HSA scenarios

These scenarios discuss three situations, each with its own set of circumstances, objectives, available resources and potential outcomes. What they have in common is that each uses an HSA to achieve short- and long-term goals.

The three scenarios below are for illustrative purposes only. Every client is unique and should consider the whole of their financial situation.

older couple sitting on a sofa reading a book

Scenario 1

Meet Greg and Jane, who are saving for retirement

- They’re in their early 50s, in good health and have modest health care costs

- They’ve been saving for retirement and usually make the maximum 401(k) contribution

- Greg’s employer recently switched to a high-deductible health insurance plan, which creates another savings opportunity

- They decide to contribute their annual family maximum of $8,550 to their HSA (for 2025)

- They can grow earnings more rapidly because the contributions, and the growth on those contributions, aren’t taxed

- They accelerate growth by paying most minor health care costs out of pocket

- They allow the balance to grow and use those savings to help pay for health care costs in retirement

Scenario 2

Meet Susan, who is young and healthy

- She’s 32 years old, single and recently promoted

- She takes great care of herself, so she has very low health care costs

- She’s been contributing to her 401(k) and her HSA at work, but thought she had to use all of the HSA each year or lose those dollars

- Susan learned that she can let her HSA balance grow each year, and she could roll her HSA into her own account with any HSA vendor if she ever changes jobs

- Susan can use her HSA when she has health care expenses or let it continue to grow until she retires

- Even if she doesn’t need it for health care costs, she can access the funds without penalty once she reaches age 658

couple sitting at a picnic table looking at a tablet

Scenario 3

Meet Doug and Mary, who are planning for parenthood

- Both 25 years old, they're recently married and are thinking of becoming parents soon

- They’re currently saving enough in their 401(k) plans to get their full employer match, and they have an emergency fund to cover a few months of expenses

- Mary received a raise of $3,000, so they’re deciding where they might save the additional income

- They’re likely to face significant costs when they become parents, given that their family deductible is $6,000

- By saving the $3,000 in their HSA for 2 or 3 years, they could potentially have enough to cover their deductibles

- Because the savings are made and spent on a pretax basis, they could save more this way than trying to accumulate these savings in a traditional after-tax vehicle

Advantages

Employers

Employers are seeking top talent across all skill levels and realize that a robust benefits package, often including strong health care benefits, can be a key factor in attracting and retaining talent.

Another consequence of an employer offering the high-deductible health plan/HSA combination is its potential to:

- Allow older employees the opportunity to retire early if assets are available to help cover their medical expenses prior to Medicare eligibility

- Help lower the cost of providing health insurance to employees

- Free up company assets for other benefits or human resources expenses

Health care is often the largest and most misunderstood aspect of retirement income planning. The idea that a “health” account of any kind would be a talking point for a private wealth or corporate retirement financial professional may have been foreign in years past, but thanks to the HSA, not anymore.

Expand your expertise

- The inclusion of HSAs in a financial professional’s practice is a timely differentiator that demonstrates broad retirement expertise and investment acumen

- By articulating the investment opportunities in many HSAs, financial professionals can increase their value in the benefit broker and CPA referral network

- HSAs have many advanced planning implications for efficient accumulation and distribution strategies, legacy planning, long-term care financing and tax-savings strategies

Contact the Retirement Institute Planning Team at 1-877-245-0763 to learn how HSAs can help employees save for retirement.

Related topics & resources

Older couple walking through forest together

Nationwide CareMatters®

This single-life coverage is for clients who are primarily looking for long-term care coverage and want to be able to recover their costs if they never need care.

[1] “U.S. population by generation 2023,” Veera Korhonen, statista.com/statistics/797321/us-population-by-generation/#statisticContainer (Aug. 6, 2024)

[2] “Multigenerational Survey Shows How Retirement Planning Is Changing,” Nathan Reiff, investopedia.com/how-retirement-planning-is-changing-5224176 (April 4, 2022).

[3] “Projected Savings for Medicare Beneficiaries Need Health Expenses Increased Again in 2023” EBRI (January 29, 2024).

[4] “2023 Year-End HSA Market Statistics & Trends Executive Summary,” Devenir Research (March 26, 2024).

[5] The Medicare Prescription Drug, Improvement, and Modernization Act of 2003.

[6] HSAs are not taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states, but not all, recognize HSA funds as tax free. Please consult a tax advisor regarding your state's specific rules.

[7] “2023 Year-End HSA Market Statistics & Trends Executive Summary,” Devenir Research (March 26, 2024).

[8] Prior to age 65, if the HSA assets aren’t used for health care expenses, there is a 20% penalty, according to IRS Publication 969 (2022).

[9] The Nationwide Retirement Institute® 2024 Health Care Costs in Retirement Survey,” conducted online within the U.S. by The Harris Poll on behalf of Nationwide (August 2024).

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

Federal income tax laws are complex and subject to change. The information provided is based on current interpretations of the law and is not guaranteed. Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.