Loading...

The power of informed decisions: Helping pre-retirees optimize their total retirement income

People in their 50s and 60s face a series of critical decisions that will significantly influence their financial security for the rest of their lives. These decisions include when to retire, when to start their Social Security benefits, and how to deploy their retirement savings to generate lifetime retirement income. Often pre-retirees make these decisions without fully understanding the impact of their choices on their annual retirement income.

This article illustrates an analysis that can help inform pre-retirees of these consequences. It estimates retirement income under several scenarios for a hypothetical couple, Reggie and Tonya. With this information, they can feel more confident about their retirement decisions.

Introducing Reggie and Tonya

Reggie and Tonya are both currently age 60 with $1 million in retirement savings. They both work, and their combined household income is $175,000 per year. Neither one has any benefits from a traditional defined benefit pension plan.

Reggie and Tonya worked with a financial professional to analyze when they should retire, whether they should work part time for a while, and how to position their retirement savings to generate lifetime retirement income.

5 revealing scenarios

Here are the 5 scenarios that Reggie and Tonya's financial professional reviewed with them:

- The baseline case assumes that they both work full time until age 62, then they both retire full time, immediately start their Social Security benefits, and use their retirement savings to generate lifetime retirement income.

- The first alternative scenario assumes that they both work part time from age 60 to 65, then they both retire full time, start their Social Security benefits, and use their savings to generate retirement income.

- In the third scenario, they both work full time from age 60 to 65, then they both retire, start their Social Security benefits, and use their savings to generate retirement income.

- In the fourth version, they both work part time from age 60 to 70, then they both retire, start their Social Security benefits, and deploy their savings to generate retirement income.

- Lastly, they both work full time from age 60 to 70, then they both retire, start their Social Security benefits, and use their savings to generate retirement income.

For the scenarios with full-time work (delayed retirement), they are assumed to contribute a total of 15% of their pay to their savings, including their employer’s match. For the scenarios with part-time work (phased retirement), they are assumed to stop contributing to their savings. The phased retirement scenarios create a bridge until the age they can afford to stop working entirely.

The baseline case assumes that Reggie and Tonya deploy their retirement savings at retirement as follows:

Please see below for more details on the assumptions used for the analyses.

Working longer significantly increases retirement income

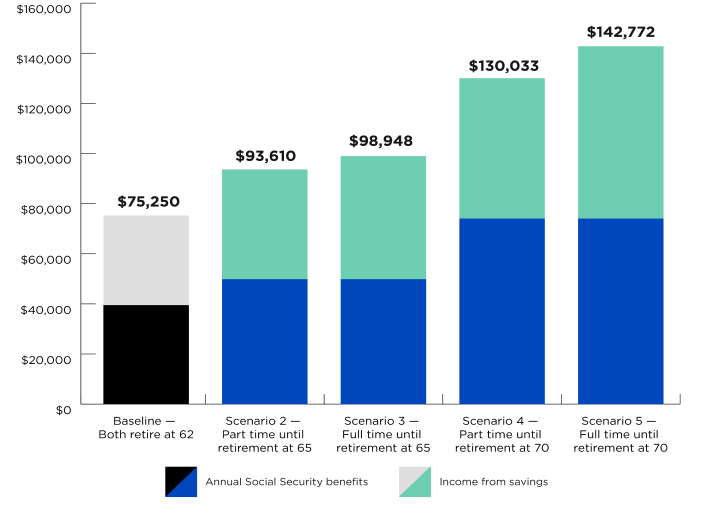

Figure 1 shows the couple's total income in their first year of retirement, combining their estimated Social Security benefits with the income that comes from tapping their retirement savings.

The estimated retirement income amounts are gross amounts, before paying income taxes, and are expressed in today’s dollars.

Figure 1

Comparing 5 options: When to retire?

Reggie and Tonya's annual retirement income in first year

The illustration is hypothetical and is not intended to serve as a projection of the investment results of any particular participant or investment option. Actual results will vary.

Here are two significant conclusions that Reggie and Tonya can draw from this graph:

- Working longer significantly increases their retirement income. For example, their total estimated retirement income almost doubles between retiring at age 62 compared with retiring at age 70, increasing from $75,250 to $142,772.

- Phasing into retirement results in more income and the possibility of more enjoyment/less stress. Compared with the baseline option of retiring early, if the couple works part time between ages 60 and 65, their total retirement income is $93,610, compared with $98,948 if they work full time between ages 60 and 65. This result could justify working just enough to cover their living expenses and start enjoying life, while allowing their retirement income to grow.

Figure 1 shows their total retirement income in the first year of retirement. Thereafter, their Social Security income increases annually to adjust for inflation. Their future income from savings depends on investment returns credited to the guaranteed retirement-income product and earned by invested savings.

Retirees may wish they had more spendable income in retirement

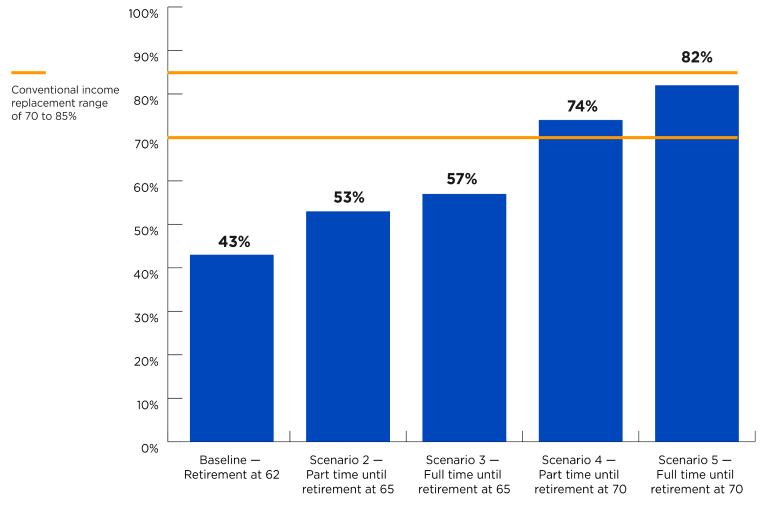

Figure 2 shows Reggie and Tonya’s retirement income as a percentage of their pre-retirement pay; this percentage is known as a “replacement ratio.” Financial professionals often recommend that retirees replace 70% to 85% of their pre-tax, pre-retirement pay, a target that is intended to replace all their after-tax spendable income. Still, that's not always sufficient. Recently, Nationwide polled retirees and found that over half (55%) said their living expenses stayed the same in retirement.1 Financial professionals should encourage clients to consider more closely the personalized levels of income they're likely to need.

Figure 2

Income replacement ratios in retirement

Combined Social Security benefits and income from savings

Figure 2 shows that Reggie and Tonya won’t achieve these typical recommended replacement ratios unless they work in some way until age 70. For example, if they retire at age 62, their retirement income would be less than half of their pre-retirement income, so they will fall far short of the recommended replacement ratios. This is a typical result for many of today’s pre-retirees.

As a result, Reggie and Tonya will need to balance their desire to retire with the standard of living they want during their retirement years.

The retirement income estimates shown in this article rely on Reggie and Tonya’s circumstances and the assumptions listed below. Estimates for specific individuals can vary significantly from the results shown here.

However, the general conclusions regarding the power of delaying retirement and replacement ratios apply broadly to many of today’s pre-retirees. In addition, the calculations illustrate the types of analyses that can help individuals make critical retirement decisions.

Assumptions

- All retirement income estimates are calculated in today’s dollars.

- Social Security benefits were estimated using Social Security’s Quick Calculator.

- 15% of pay is contributed to retirement savings when working full time; there are no contributions when working part time.

- Savings and future contributions earn a 3% real annual return (after inflation).

- The baseline case assumes 30% of savings is devoted to a guaranteed retirement-income product from an insurance company upon retirement, with the following payout rates (for a married couple):

- Age 62: 4.35%

- Age 65: 5.7%

- Age 70: 5.9%

- The baseline case assumes 70% of savings is invested using required minimum distribution (RMD) methodology to determine the annual payout, with these payout rates:

- Age 62: 2.72%

- Age 65: 2.95%

- Age 70: 3.42%

Clients need you to help them "get real" about retirement

As mentioned at the beginning, many pre-retirees make decisions without fully understanding the consequences. It's a good use of time to explore strategies to optimize their Social Security benefits and identify alternative ways to generate retirement income from savings. Both approaches have the potential to produce higher amounts compared with the baseline strategy used in this example.

The calculations shown here are beyond the capabilities and experience of most individuals. Financial professionals and retirement plan sponsors can play an important role to help inform and guide their clients in planning for retirement. This information may help enable them to retire with confidence and dignity.

Share this information to help pre-retirees make difficult decisions.

Most pre-retirees today face potentially difficult decisions: Delay their retirement, reduce their spending or a combination

of the two. It will significantly help them make these trade-offs if they understand the potential impact on their annual

retirement income.

[1] “The Nationwide Retirement Institute 2024 Social Security survey,” conducted by The Harris Poll on behalf of the Nationwide Retirement Institute. This online survey was conducted April 19 through May 13, 2024, among 1,831 U.S. adults age 18 or older.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

This information is general in nature and is not intended to be tax, legal, accounting or other professional advice. The information provided is based on current laws, which are subject to change at any time, and has not been endorsed by any government agency. Please consult an attorney or tax advisor for answers to specific questions.

Sponsorship of a third party does not imply endorsement of the information presented. Views and opinions are those of the author.

Neither Nationwide nor any of its affiliates are related to or affiliated with Steve Vernon or Rest-of-Life Communications.

Guarantees are subject to the claims-paying ability of the issuing insurance company

Related topics & resources